In a world that’s more connected than ever, the realities of modern life often stretch across borders. Whether you’re a migrant worker sending money home, a diaspora member maintaining ties in multiple countries, or someone whose work or life has taken you across different African nations (or indeed overseas), the traditional confines of insurance can no longer keep up.

That’s where Mutual Life Africa comes in — delivering insurance policies designed without borders, built around mobility, diversity and simplicity.

Here’s how our approach is different — and why borderless insurance is not just a promise, but a lived reality for our clients.

What Does “Borderless Insurance” Mean?

At Mutual Life Africa, borderless insurance means:

- Flexibility across geography — your cover doesn’t get stranded if you move between countries. Whether you relocate, travel, or live in more than one place, your policy moves with you.

- Inclusivity of nationality and residency status — you can purchase cover regardless of your nationality, whether you are foreign-born, an expat, diaspora, or local. Regulatory boundaries don’t prevent eligibility.

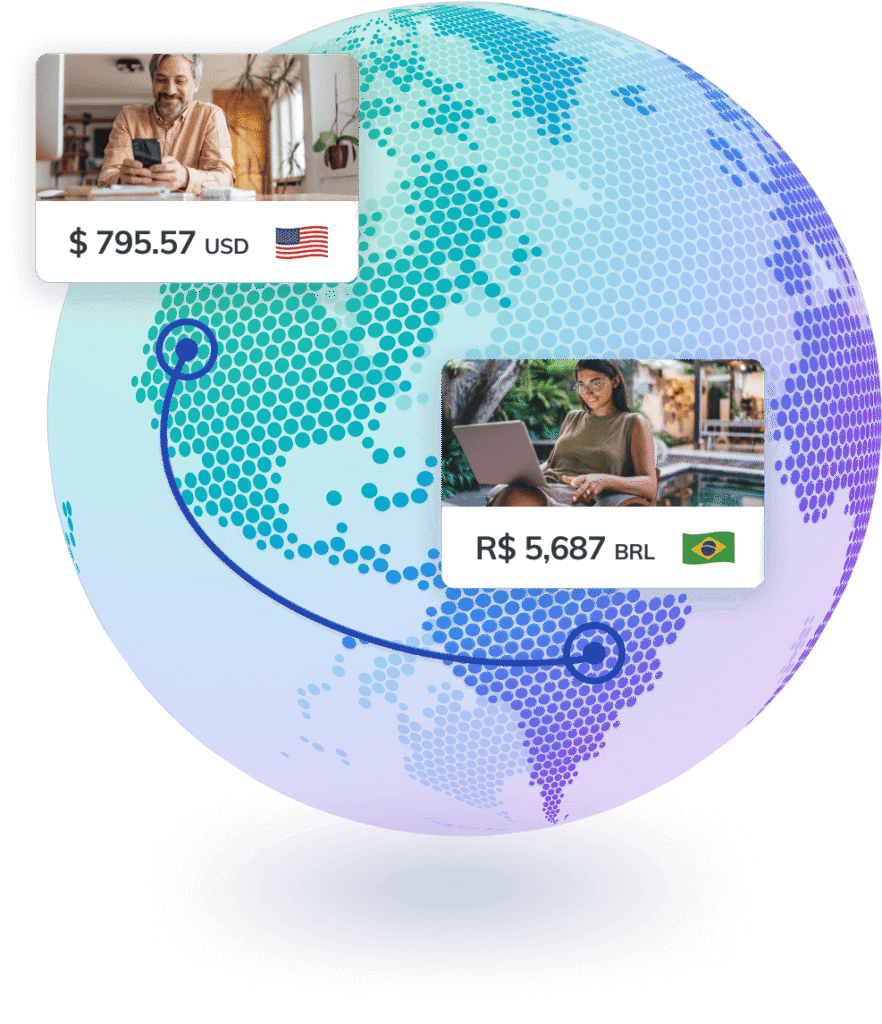

- Currency options — policies are offered in USD and ZAR (and possibly other currencies depending on region), enabling clients to choose what makes the most sense for them, their savings, and their obligations.

- Global claims support and faster processing where possible — because when things happen abroad, time is critical. There’s no waiting on borders to settle what needs to be settled.

Key Features That Bring This to Life

Here are some of the policy and service features that illustrate “borderless” in practical terms:

- Life Cover Designed for Mobility

- You can maintain and continue your cover even if you move to a different country.

- Transnational cover plans — meaning simpler, less bureaucratic cross-border portability.

- Funeral Cover for Extended Family, Across Regions

- Policies can cover many family members across borders, not just nuclear family in one country.

- Amounts that are meaningful even in higher-cost settings.

- Affordable Premiums, Transparent Pricing

- Designed so that people with varying income levels can afford meaningful cover. Premiums match budgets yet deliver value.

- Clear pricing in multiple currencies, so clients aren’t blindsided by exchange rates or hidden costs.

- Fast, Customer-Centric Service

- Efficient claims handling so that payouts are timely, even when beneficiaries or policyholders are in different countries.

- Multilingual / culturally aware support teams that understand cross-border issues.

- Regulatory & Compliance Strength

- Licensed and regulated in many countries, which gives customers confidence that the policy is legitimate and enforceable across borders.

- Part of a global group (Spartan Ives) with the financial strength and governance to back up promises.

Why Borderless Insurance Matters

- Life is mobile: People are increasingly working, living, or supporting dependents across countries. A policy that ties you strictly to one location is not realistic anymore.

- Diaspora & Migrants face gaps: Many insurance providers treat nationality or residency as fixed, making it difficult for diaspora or migrant workers to get coverage.

- Currency & cost concerns: Remittances, debts, and family obligations often involve multiple currencies. Being able to hold a policy in a stronger or more stable currency (USD, for example) protects value.

- Peace of mind across frontiers: Knowing you’re covered wherever you go or whatever happens in multiple places is a huge mental burden lifted.

Real Stories / Use Cases (can include quotes later)

- A Zimbabwean working in South Africa who supports family back home and moves back and forth — with Mutual Life Africa, their life cover remains valid, claims can be made even across border, and funeral cover can be extended to family in home country.

- An expat from Nigeria living in Europe wants to ensure that if anything happens, the payout goes to dependents in both Europe and Africa — and can choose the currency that best protects their dependents.

If you’re living across borders — physically, financially, emotionally — you deserve insurance that keeps pace. At Mutual Life Africa, we believe insurance shouldn’t have walls. We build it for movement. For connection. For life, wherever life leads.

👉 Ready to get borderless cover? Explore our Life & Funeral Cover plans today. Let’s secure your future—across any boundary.